EKYC

Frictionless customer onboarding

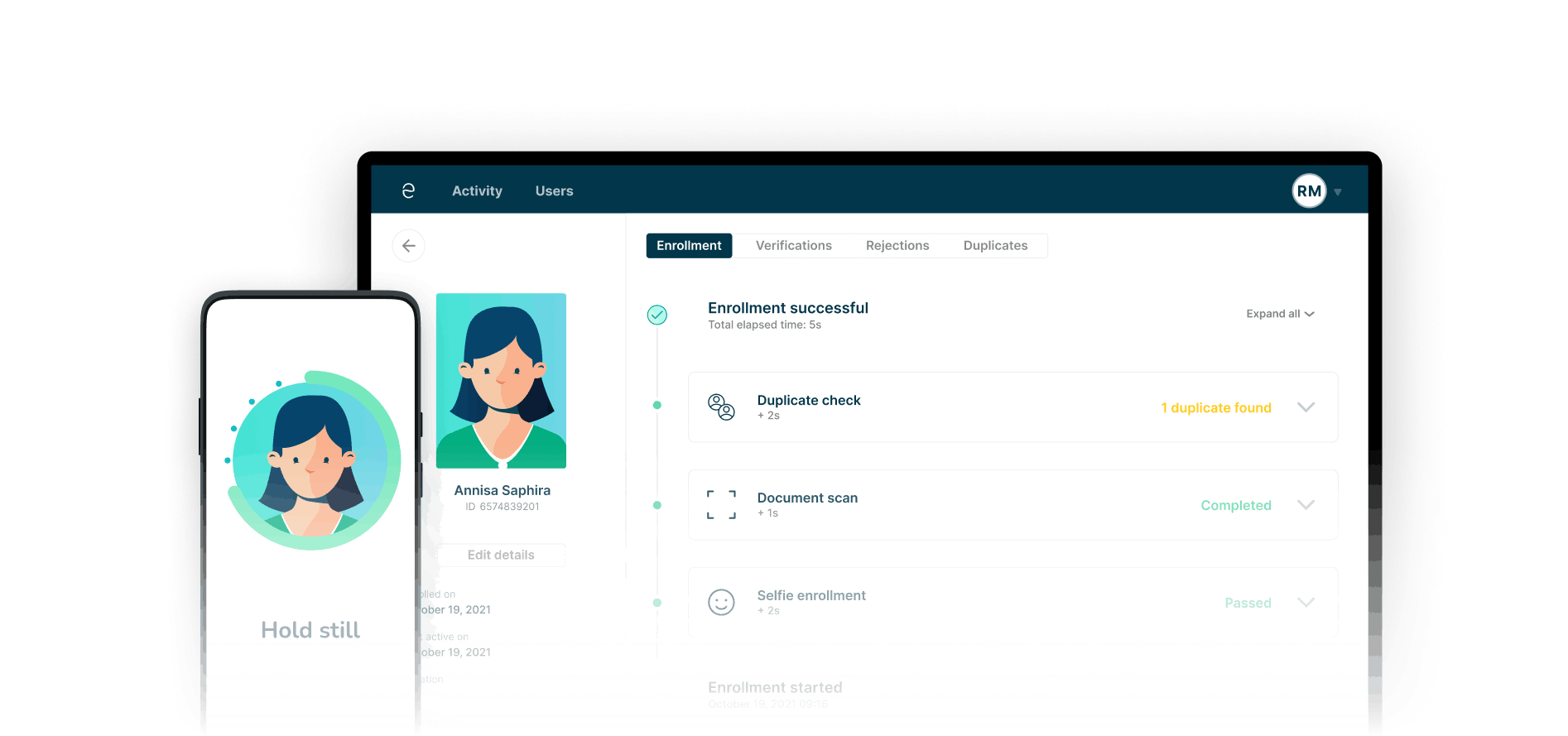

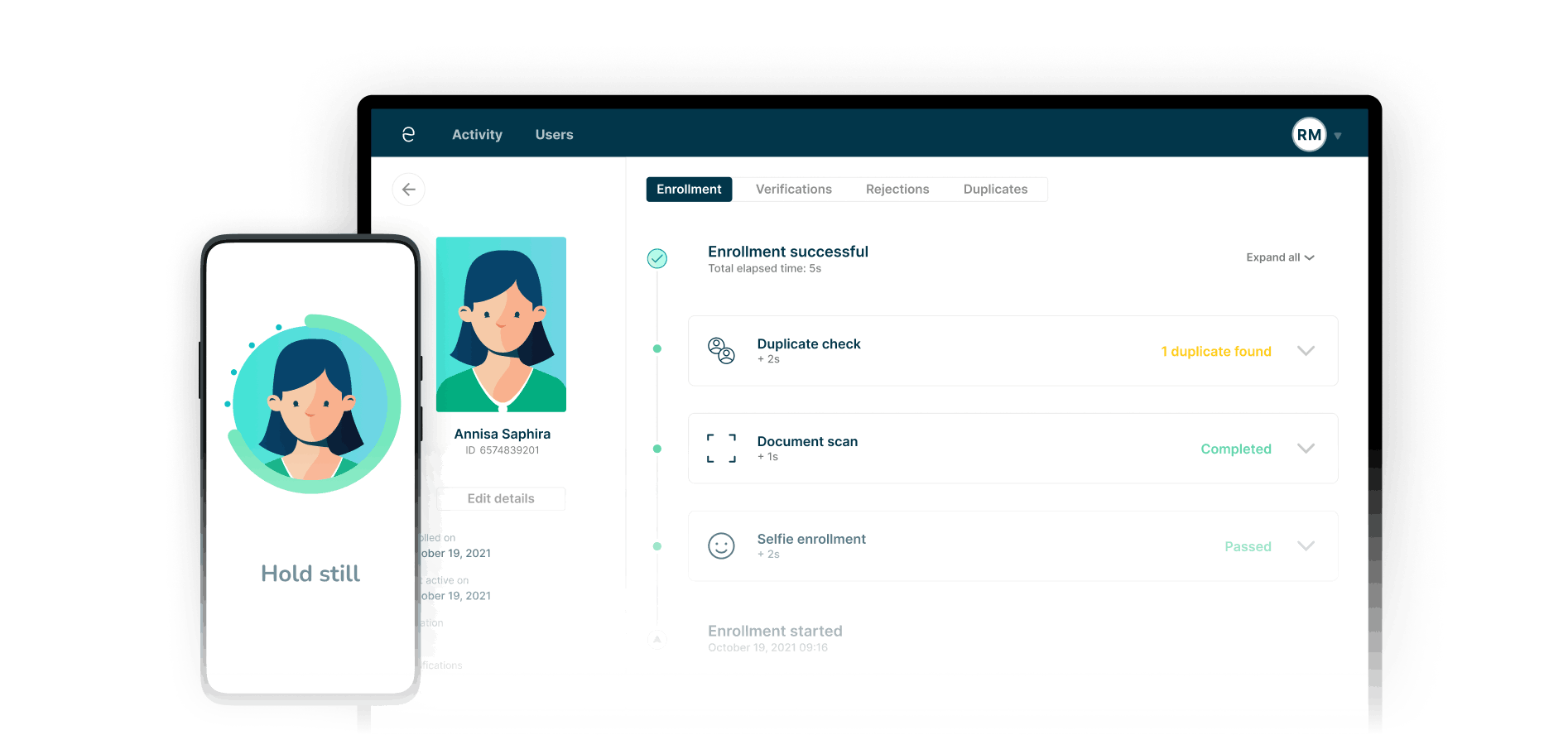

Element Inc.'s eKYC solution verifies government-issued documents in real time.

Platform overview

Identity verification

Reliably ensure customers are who they claim to be with high performance biometrics

and liveness detection.

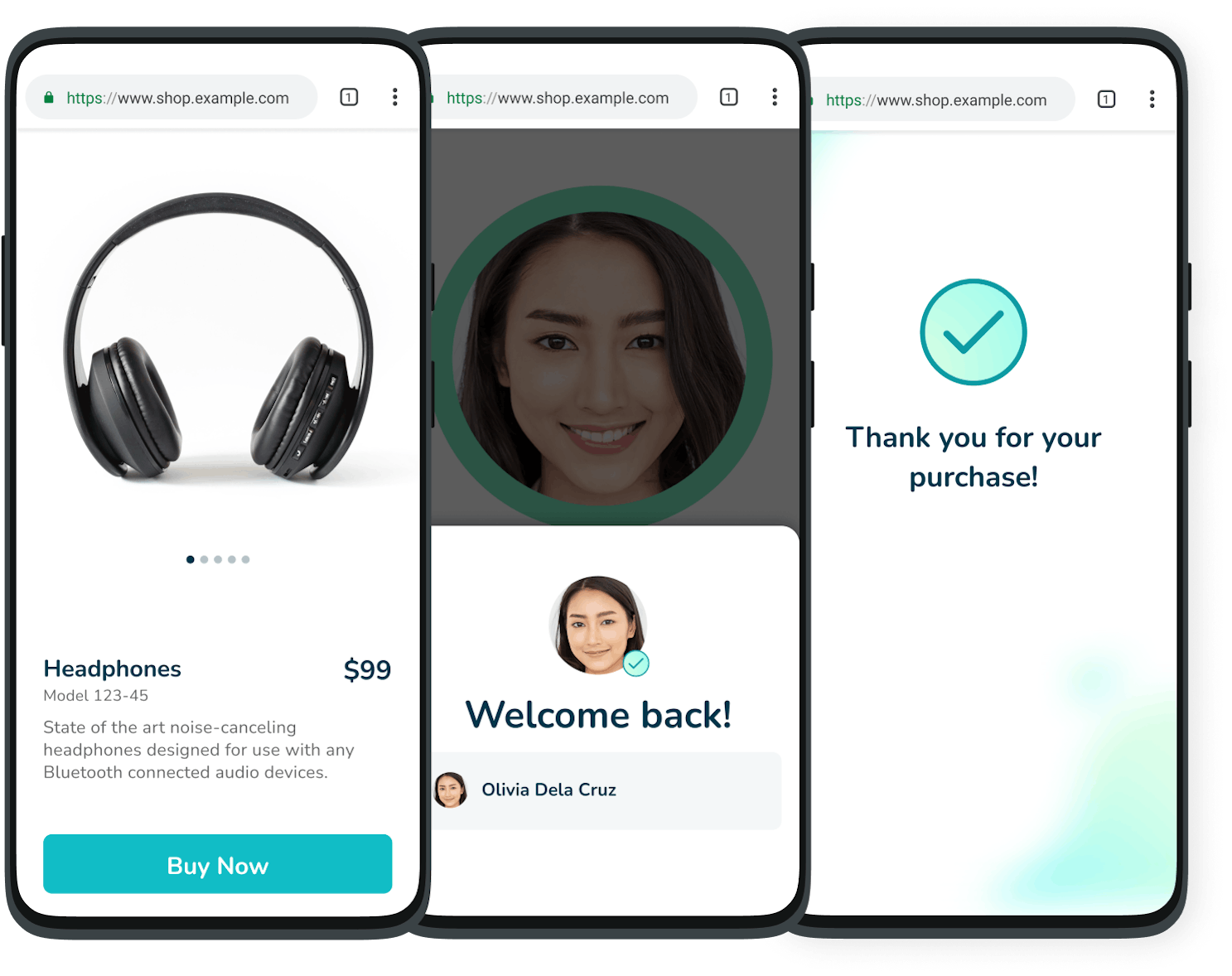

Cross-channel authentication

Instantly secure transactions with intuitive security features.

eKYC / ID card verification

Verify government-issued documents in real time via licensed API's with regulatory

databases, with optional integration with ID validation review systems.

Customizable workflow

Our customizable components lets you create the optimal journey that your users take

to becoming trusted customers.

SELFIE ENROLLMENT

Element's selfie enrollment delivers

fast, accurate, and seamless customer onboarding with our proprietary stack of advanced deep learning

models.

Our solution can be customized for customer thresholds and ease of use - including both

passive and interactive implementations.

Human-centric design ensures an easy-to-use UX, making account creation and authentication

fast and frictionless.

Protects against presentation attacks by assessing image quality, textures, reflections,

depth, distortions, and user attention.

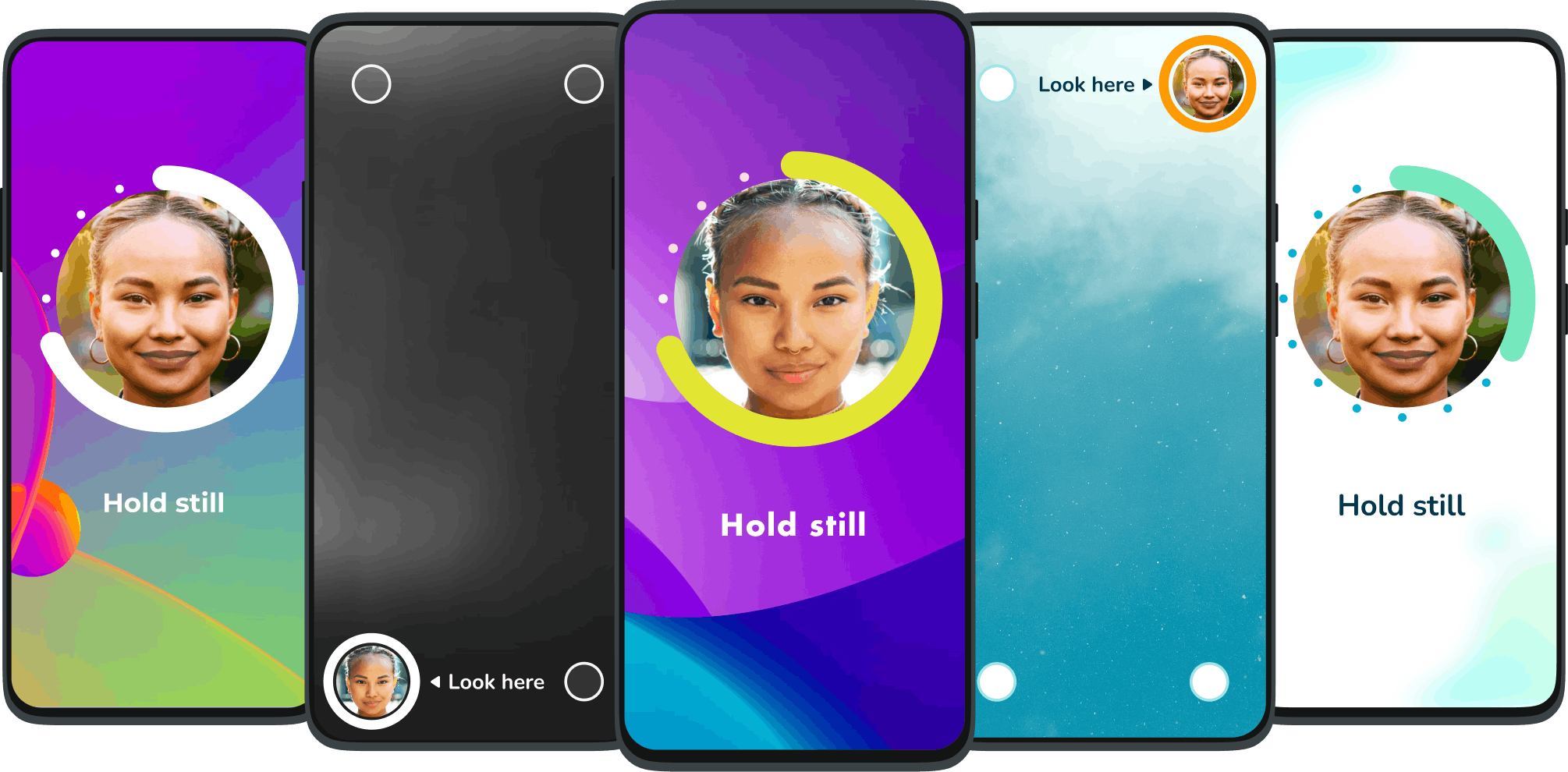

SELFIE LIVENESS

State-of-the-art attention liveness anti-spoofing

technology

More intuitive and frictionless than most selfie liveness products in the market.

Multi-platform

Web API-based enrollment

The Web API can easily be integrated and be called from a

host of web-based embedded financial services use cases, including:

STAYS TRUE TO YOUR BRAND

Customizable UI

Differentiate your platform and design your interface in a way that delivers the

vision and inspiration of your brand.

eKYC model pipeline

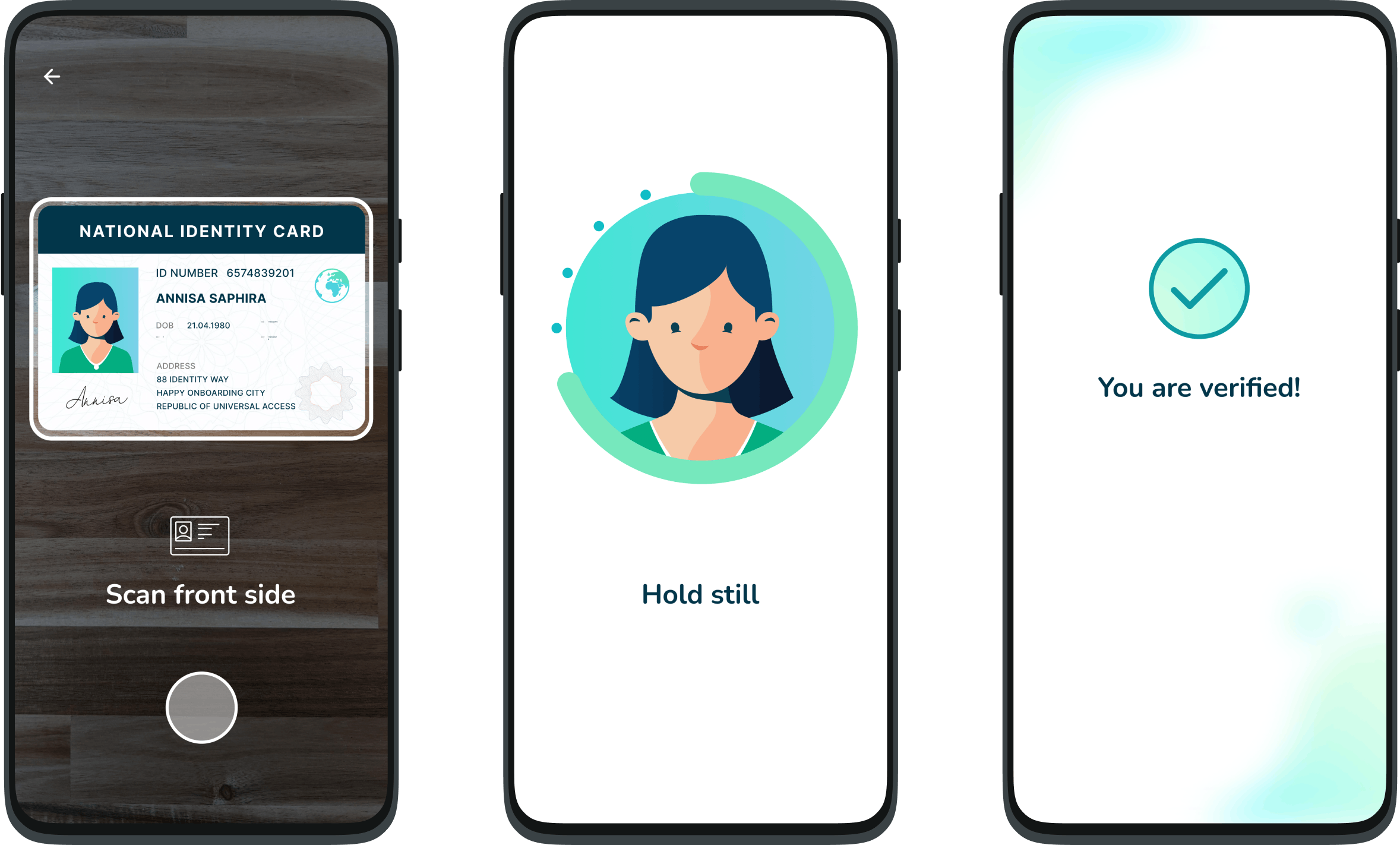

Credentialed ID scan with OCR

Registrants enroll by scanning an official form of government-issued ID Card approved for

the transaction type. Leverages OCR and additional technologies to reduce fraud and improve the customer

experience.

Biometric enrollment

Enrollment of face modality to comply with eKYC regulations of identity validation with ID

Card or Civil Registry. A unique user model that cannot be reverse-engineered is created, which can be

used for future verifications.

Liveness detection

On-device liveness detection & anti-spoofing is critical to prevent fraud via presentation

attacks and is often a regulatory requirement for eKYC as a replacement for in-person validation

processes.

Verification

Advanced performance matching of live selfie with government-issued ID Card or Civil

Registry. Match is issued a confidence score and can optionally be backed up with an additional layer of

human validation.

The Element Inc. advantage

Our partners choose to work with us

because we deliver faster access without compromise - securely connecting anyone to any service while

retaining the right to privacy. Together, we're building a frictionless future.

Deep understanding of each country's need

Element Inc.'s international presence allows us to work closely with the requirements of the markets we

serve. Our presence in New York, Singapore, Manila, Jakarta, Bangkok, and Taipei lets us build strong,

lasting partnerships in making identity solutions possible for everyone.

Mobile software for scale

Single software platform for digital onboarding, eKYC, and continuous authentication, built with the

global state-of-the-art in mobile AI biometrics technology.

Universal by design

Element's state-of-the-art deep learning algorithms learn directly from natural features, adapt to

changes in features over time, and integrate easily into most systems.

Portable & scalable

Our 2KB user model size is configurable for on-device or server-side processing to fit to customer

requirements.

Secure & private

Element supports the identity life cycle without having to rely on PII or transactional data - providing

users with abstracted identity models that cannot be reverse- engineered, and a native security

architecture.

Platform agnostic

Goes everywhere your users are: Android, iOS, and Web compatible.

Success story

Access Bank increases financial inclusion in Nigeria and Africa

To expand its digital banking services in Nigeria and Africa, Access Bank partnered with Element Inc. to

implement its eKYC, digital onboarding, and mobile security to the bank's flagship FacePay application

for

merchant and branch banking, the NextGen mobile application - Access More, and WhatsApp Banking.

"We are delighted to have executed these innovations in line with our vision and in partnership with a

company that has demonstrated technical excellence and high performance in the execution of this

project.”

Daniel Awe

Head of Africa Fintech Foundry (an initiative of Access Bank)