Risk platform

Protect your customers and your business from identity fraud

Element's risk solutions provide enterprises with advanced tools to block fraud at the data system level,

detecting high risk account and transaction activity with a platform that scales its classification power

with your requirements.

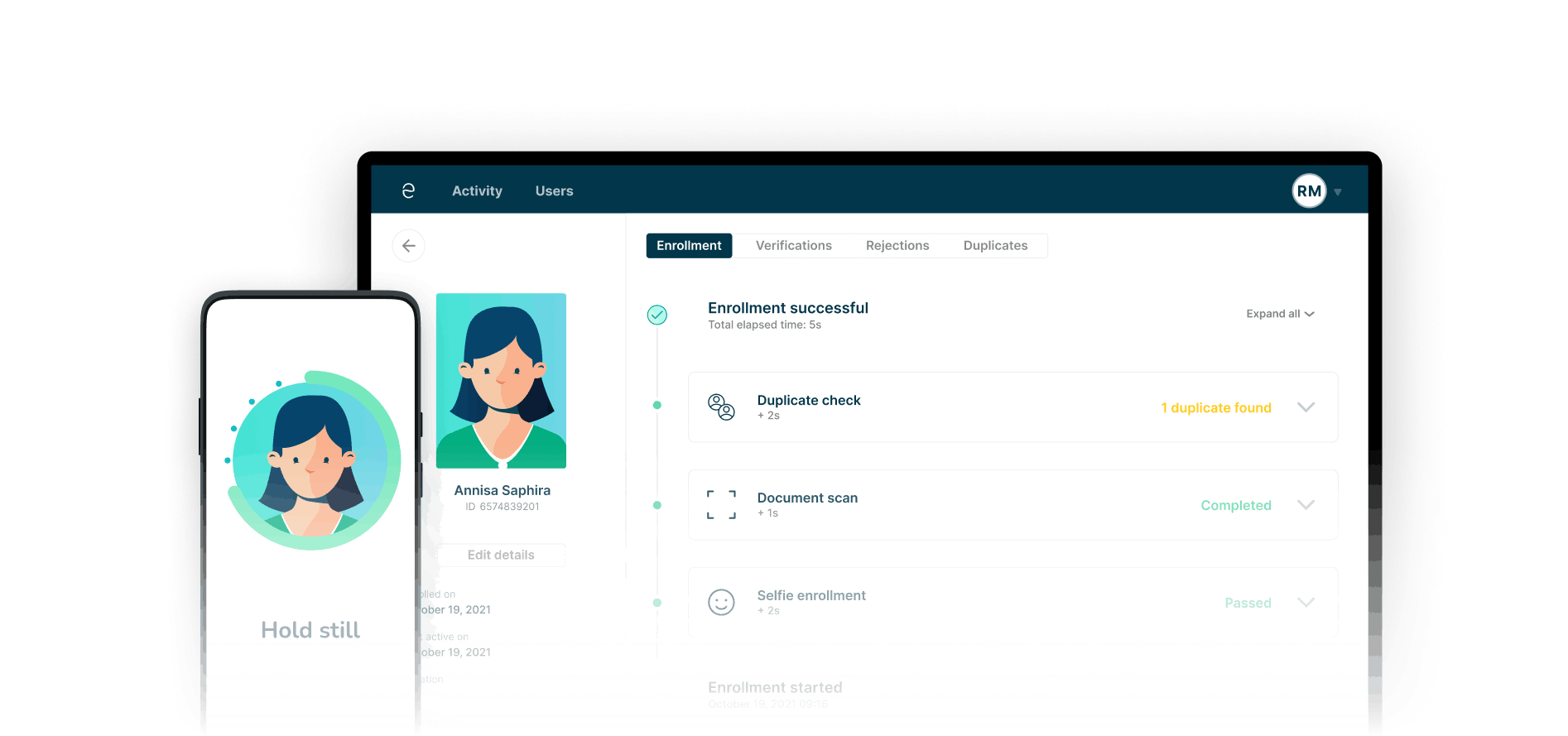

Database Search & Deduplication

Seamlessly integrated with our eKYC and Authentication solutions, the 1:N

Search and Deduplication products level-up the performance of your identity management platform

significantly, by providing:

Data integrity

Confidently merge existing databases ensuring duplicate records are identified for

review and synced.

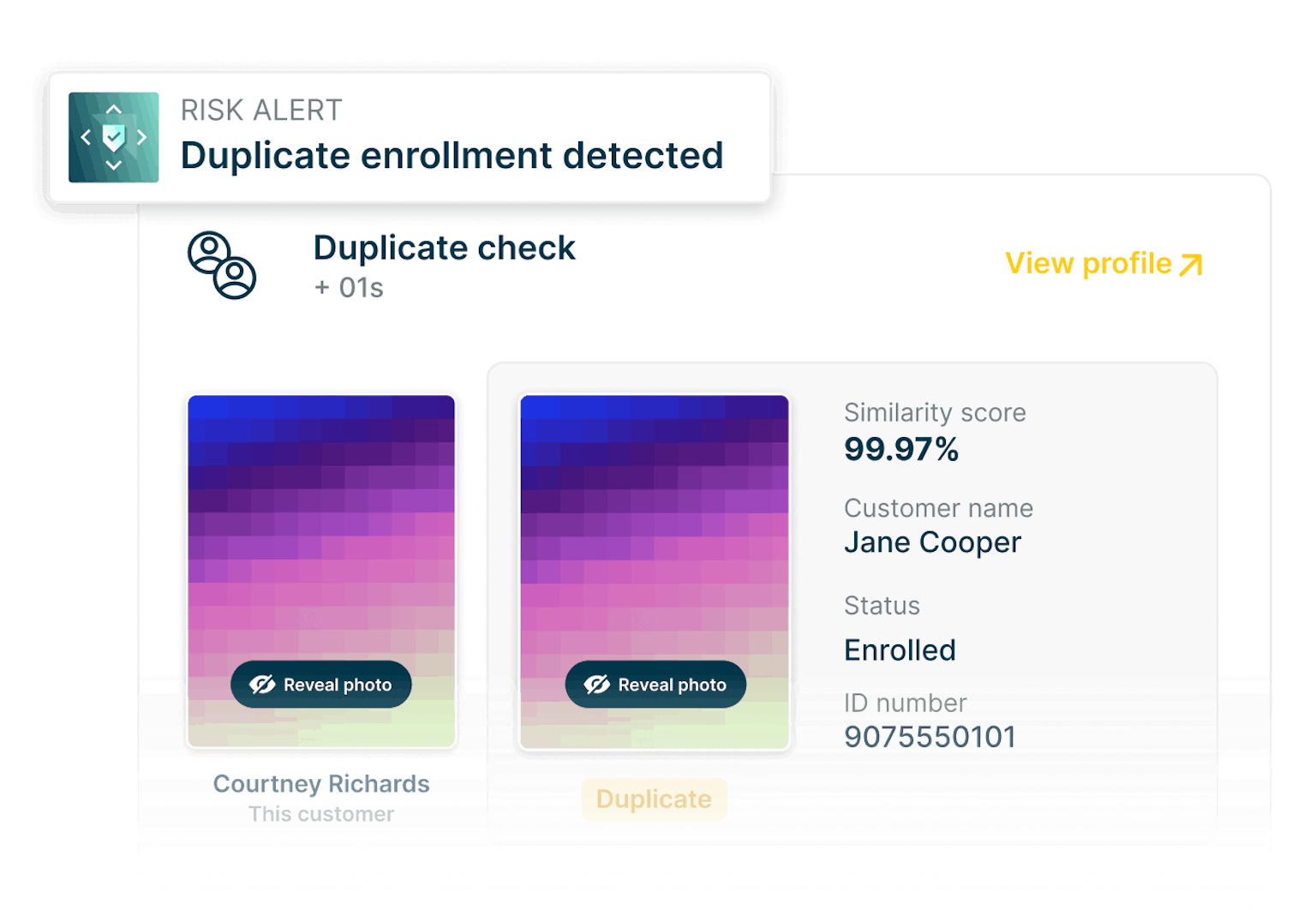

Fraud prevention

Flag potential repeat fraudsters by matching previously registered users.

Convenience

Fast-track user onboarding, and account recovery for existing customers, to drive

utilization and positive user experience on your platform.

GRAPH NEURAL NETWORKS

Fraud Systems Powered by Advances in Graph Deep Learning

Led by subject matter experts in Graph Deep Learning and in partnership with our financial services, e-commerce and consumer internet partners, we are building state of the art systems for detecting fraud across large scale digital platforms, to provide a significant step up in user account security and platform integrity.

We welcome digital platforms across the world to get in touch with us about how we can help address your fraud needs. Early partners will receive substantial attention from our world class AI team. If you're interested in learning more, please contact us.

The Element Inc. advantage

Our partners choose to work with us

because we deliver faster access without compromise - securely connecting anyone to any service while

retaining the right to privacy. Together, we're building a frictionless future.

Deep understanding of each country's need

Element Inc.'s international presence allows us to work closely with the requirements of the markets we

serve. Our presence in New York, Singapore, Manila, Jakarta, Bangkok, and Taipei lets us build strong,

lasting partnerships in making identity solutions possible for everyone.

Mobile software for scale

Single software platform for digital onboarding, eKYC, and continuous authentication, built with the

global state-of-the-art in mobile AI biometrics technology.

Universal by design

Element's state-of-the-art deep learning algorithms learn directly from natural features, adapt to

changes in features over time, and integrate easily into most systems.

Portable & scalable

Our 2KB user model size is configurable for on-device or server-side processing to fit to customer

requirements.

Secure & private

Element supports the identity life cycle without having to rely on PII or transactional data - providing

users with abstracted identity models that cannot be reverse- engineered, and a native security

architecture.

Platform agnostic

Goes everywhere your users are: Android, iOS, and Web compatible.

Success story

Access Bank increases financial inclusion in Nigeria and Africa

To expand its digital banking services in Nigeria and Africa, Access Bank partnered with Element Inc.

to

implement its eKYC, digital onboarding, and mobile security to the bank's flagship FacePay application

for

merchant and branch banking, the NextGen mobile application - Access More, and WhatsApp Banking.

"We are delighted to have executed these innovations in line with our vision and in partnership with a

company that has demonstrated technical excellence and high performance in the execution of this

project.”

Daniel Awe

Head of Africa Fintech Foundry (an initiative of Access Bank)